Do you have money or investments overseas?

Forths provide specialist tax advice to individuals with unpaid tax liabilities

If you have unpaid tax, we can assist. We are not HMRC, we assist individuals who are looking to clean up their tax affairs.

We offer a FREE Initial 10 Minute Phone Consultation

If you have money held overseas, for example, in an offshore bank account, and have not declared this to HMRC, you may have unpaid tax liabilities.

Our team can help clarify your position.

We have assisted many individuals, mostly through the Worldwide Disclosure Facility and will discuss your circumstances to understand your potential liability.If HMRC suspects and has evidence to suggest you have unpaid tax liabilities, you may face a full Tax Investigation into your affairs.

Contact us today.

What does your tax query relate to?

Property Rental Income

If you have undeclared income from rental property, our team can assist.

We have helped many individuals bring their tax affairs up to date with HMRC through the Let Property Campaign. Contact our experienced team.

Money / Assets Held Overseas

If you have assets or money held overseas, you may still have a tax liability to pay in the UK. Due to global tax transparency laws, tax authorities around the world are able to share information.

We can help you understand your position.

Online Trading via eBay etc

If you generate income from online sales via platforms such as eBay, Etsy, Vinted, Depop, AirBnb, Only Fans, Patreon, Spotify etc, you may have unpaid tax liabilities.

Talk to our team if you have been trading items, selling online and generating income.

Crypto Currency/ Forex

HMRC is now more actively looking into crypto currency to ensure that investors are aware of their tax liabilities through such investments.

Put simply, crypto currency is subject to Capital Gains Tax in the UK if profit has been made on the investment.

A Tax Investigation can be a serious matter and can occur for a wide range of reasons. However, the crux of the matter is that HMRC suspects that you may have unpaid tax.

Talk to our experienced team today.

Voluntary Disclosures

Making a Voluntary Tax Disclosure is a good way of showing your willingness to bring your tax affairs up to date. There are a number of options available if you have unpaid tax. Our team will discuss your circumstances and assist you through the process with HMRC.

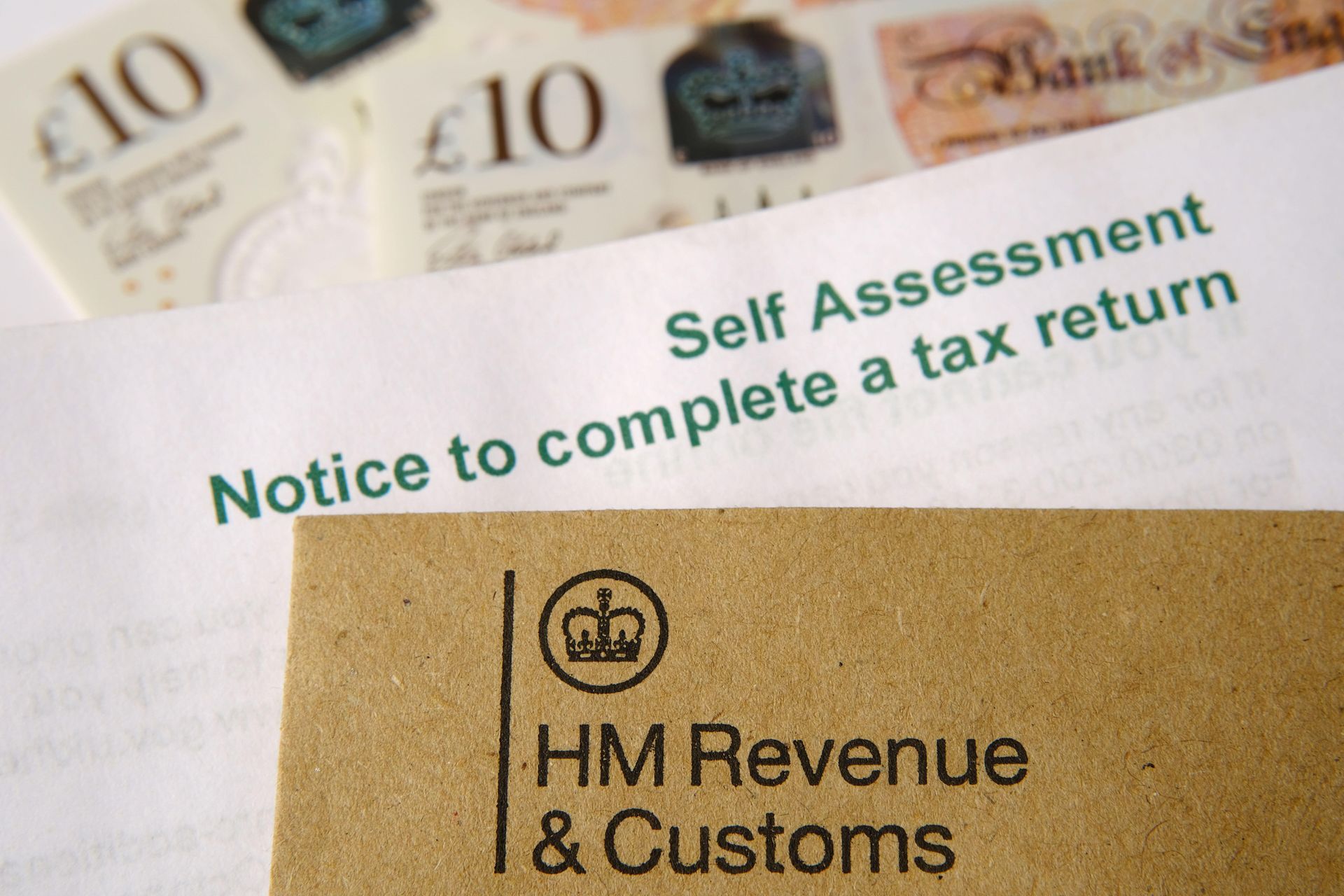

Received a Letter from HMRC?

If you have received a letter from HMRC which suggests you have unpaid tax or is inviting you to clarify your affairs, you should seek professional advice.

Contact us today to discuss your circumstances in confidence.

Contact us today to find out how we can assist you...

To hear more about our Tax Investigation Services or to discuss a potential case with a member of our team, call us on 0113 387 5670.

Alternatively, you can email us at enquiries@forthsonline.co.uk or fill out an Enquiry Form and we will contact you directly.